Net Worth Definition Business

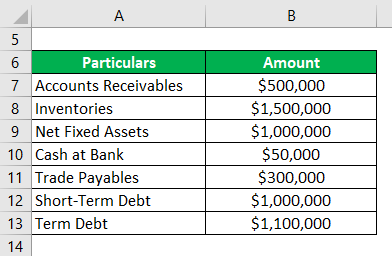

This is the total amount of all assets minus all liabilities as stated in the balance sheet. What is business net worth.

Net Worth Formula Calculator Examples With Excel Template

The information in the balance sheet may be stated at the original price of the asset or liability which may differ from the amount at which it could potentially be disposed of.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Net worth definition business. Once you settle all business debts the net worth includes what is left over. Net worth is an indicator of financial health. Most often it assesses the worth of an individual or business.

Money invested in a company can come from owners and it can come from outside investors or lenders. The total income amount or gross income. The net worth of a company or individual is simply their assets minus their liabilities or the value of the things they own minus the amount of debt they have.

Many people use net worth the number you get when you subtract your debts from your assets to measure wealth. Taxable Income Taxable Income Taxable income refers to any individuals or business compensation that is used to determine tax liability. Please note that net worth is different from market value of.

Net worth is the difference between the asset and the liability of an individual or a company. Business Also known as owners equity net worth is important because it is conveys the remaining value of all the business activity over time. When one steadily increases their net worth they are in good financial health.

The simple answer to this question is no. If you are not familiar with the concept read that article first. In financial terms net worth is the sum of your assets and your liabilities.

Similarly a low or negative net worth will relate to a weaker financial strength and a lower credit rating thus. What is net worth. In this video on Net Worth of Company we discuss its formula calculation along with practical example������������������������ ������������ ������������������ ������������������������������ ������������ ������.

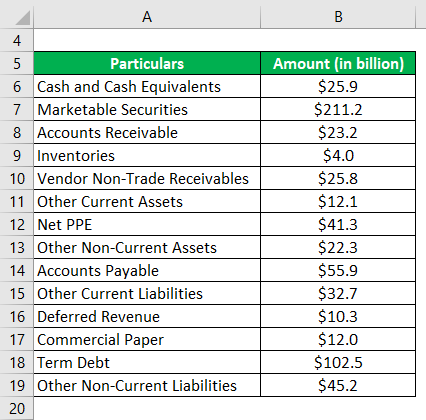

A corporations net worth is the retained earnings or the amount left after dividends are paid plus the money in its capital accounts minus all its short- and long-term debt. In business net worth is also known as book value or shareholders equity. Net worth is stated as at a particular year in time.

A high net worth is seen to be positive. While ultra-high-net-worth individuals are usually defined as having more than 30 million in investable net assets remember that this isnt a. But what number do you have to reach to become a high net worth individual.

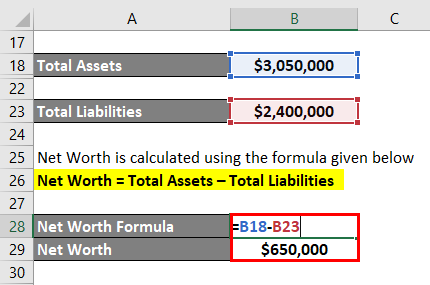

Net Worth Definition Net worth can be defined as the measure of what an individual or company is worth. Generally speaking net worth means the monetary value of all your assets minus all your debts. Net worth for a business.

Is there a net worth requirement for self-employed immigration. Net Worth of the company is the value of the assets after paying off its liabilities like debt. For a company net worth is a necessary consideration for the purposes of valuation particularly in the event of a acquisition or merger.

For an individual net worth is important for tax purposes wealth management and estate planning. For a company this is called shareholders preference and may be referred to as book value. Key Takeaways Net worth is a quantitative concept that measures the value of an entity and can apply to individuals corporations.

Net worth is the amount ones assets exceed liabilities. Net Worth for a Business The net worth for a business is the total amount of all assets minus all liabilities as stated in the balance sheet. Net worth Net worth is the measure of a companys or individuals actual worth accounting for assets as well as debts.

In business net worth is the total assets minus total outside liabilities of an individual or a company. Lenders compare net worth to liabilities in a business. The definitions are.

However I have another article that explains the net worth in detail. Net Worth means the aggregate value of the paid -up share capital and all reserves created out of the profits and securities premium account after deducting the aggregate value of the accumulated losses deferred expenditure and miscellaneous expenditure not written off as per the audited balance sheet but does not. A high net worth relates to good financial strength and ultimately good credit rating of an individual or a company.

Tangible net worth is most commonly a calculation of the net worth of a company that excludes any value derived from intangible assets such as copyrights patents and intellectual property. Net worth provides a snapshot of an entitys current financial position. You can use net worth to determine your financial health secure funding or sell the business.

However when losses are steadily reports the entitys financial health is poor. What you own is worth more than what you owe. Net Tangible Assets Net Tangible Assets Net Tangible Assets NTA is the value of all physical tangible assets minus all liabilities in a business.

In other words NTA are the. Net worth is a performance indicator that shows the value of your businesss property after liabilities are paid. Its net worth is reported in the corporations 10-K filing and annual report.

Net Worth Definition Types How To Calculate

Net Worth Formula Calculator Examples With Excel Template

Understanding Net Worth Ag Decision Maker

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Post a Comment for "Net Worth Definition Business"